Insights

Artificial Intelligence from a Value Perspective: Enabling the Evolution of Compute Power

Featured

Artificial Intelligence from a Value Perspective: Enabling the Evolution of Compute Power

Latest

All Articles ()

There are currently no articles for this filter

KEY POINTS

1. AI opportunity expands beyond the growth darlings that were the immediate and primary beneficiaries over the past year.

2. Utilities experienced the largest historical relative underperformance to the broader market in 2023; in our view, the reward relative to risk is now quite compelling for a sector that is experiencing an inflection in fundamentals.

3. We believe renewables, such as solar and wind, combined with battery storage, will play an increasing role in behind-the-meter power solutions.

Clients often ask for our views on artificial intelligence (AI) and the stock performance of the AI enabling companies that became a major driver of technological innovation and growth in 2023. Clients often anticipated our answer would be short, as they believe AI has primarily been impactful within growth-oriented strategies. While the most direct business beneficiaries of the trend to date have been graphics processing unit (GPU) manufacturers, software developers, hyperscalers1, and datacenter buildout plays, AI spending needs expand far beyond that realm. We believe several sectors and companies historically considered value-oriented will not only benefit from the proliferation of artificial intelligence computing, but they will be necessary enablers for AI to operate as envisioned.

Exhibit 1

Many people overlook strong stock performance over the recent year outside of the technology sector. When we show clients the chart in Exhibit 1, they assume it is a technology company, rather than a U.S. nuclear power company. Constellation Energy Corp. (CEG) is an independent power producer that is the largest nuclear generator in the country. Nuclear has been the first big enabler segment within this leg of the AI trade, and CEG is highly emblematic of it.

As active investment managers, we are constantly searching for overlooked opportunities in the market where we can build client wealth. The AI opportunity is expanding beyond the growth darlings that were the immediate and primary beneficiaries over the past year.

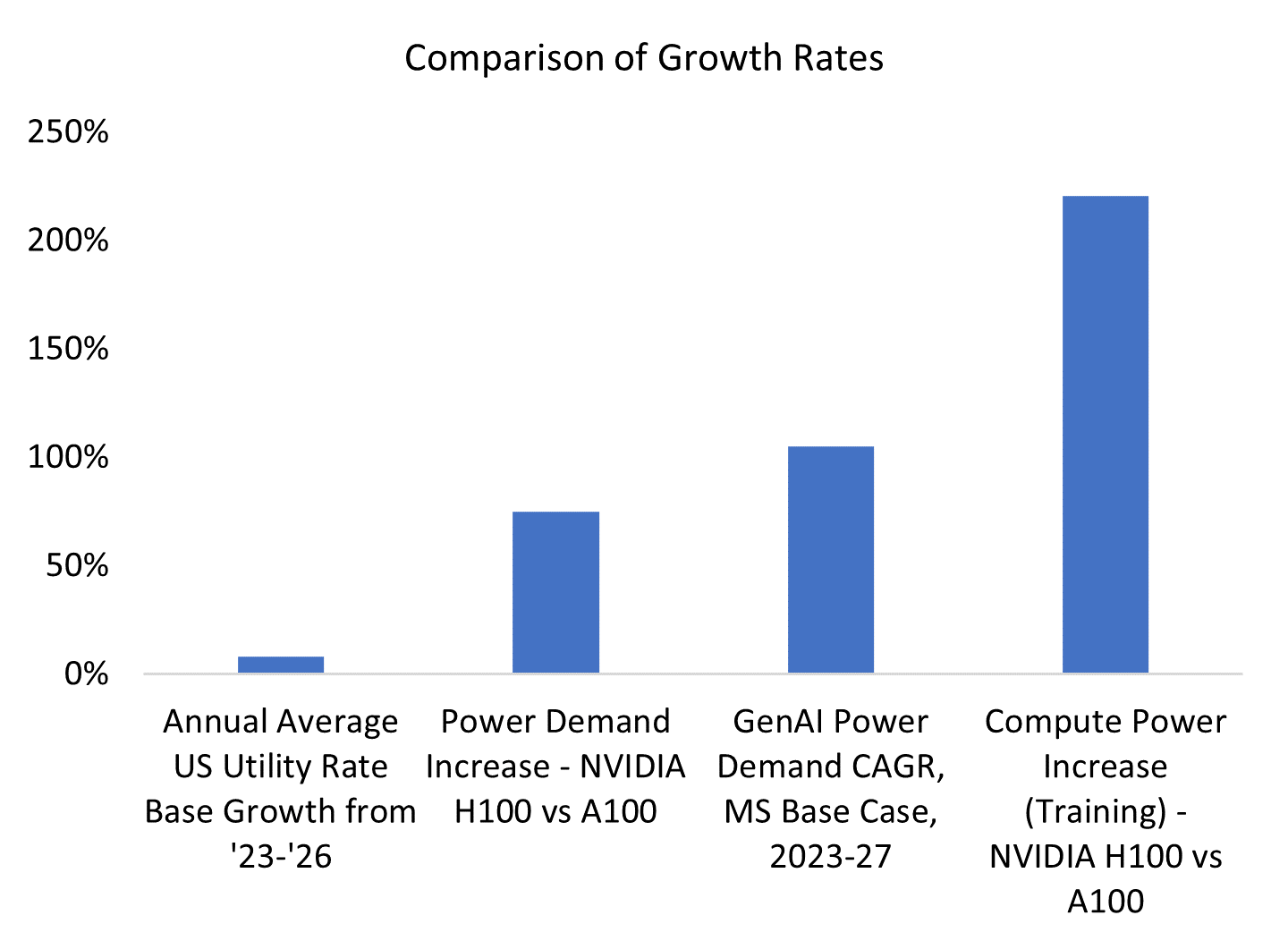

The AI value chain has several knock-on effects, including the need for additional global power for datacenters to perform. Exhibit 2 demonstrates how the power sector is growing at a much slower rate than AI power demand.Exhibit 2

Source: Company data, Morgan Stanley Research<2

Exhibit 2, which uses data estimated from Morgan Stanley Research, displays the chasm between expected growth in utilities (far left bar) versus the increased demands that more AI usage that it will put on utilities/power (three right side bars).

In early March, a transaction was announced with a major cloud provider acquiring a datacenter adjacent to a nuclear facility. Through this transaction, the provider is seeking reliable, around-the-clock power to run a carbon-neutral data center. Only recently have nuclear production assets been considered as acceptable green assets.

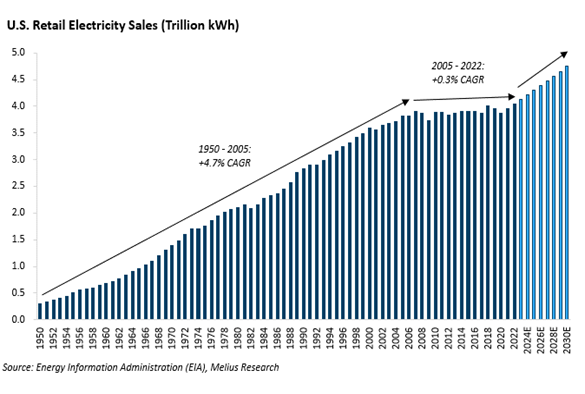

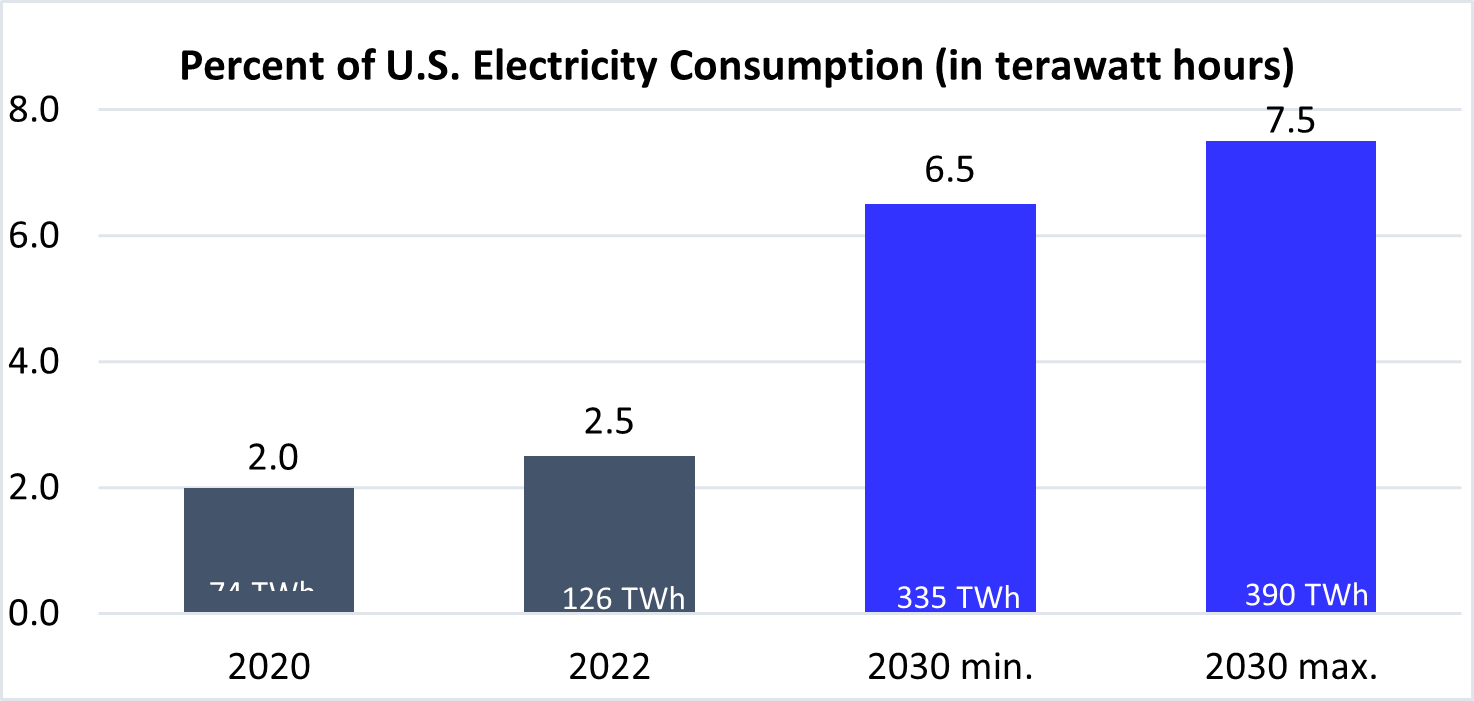

Independent power producers with nuclear assets are now able to lock up premium pricing on these power production agreements. The reason can be found in the two charts below. After nearly five decades of rising demand intensity, electrical generation demand flattened during the first two decades of the 21st century, owing to energy efficiency gains. Recent estimates project that datacenter demand for electricity is about to triple as a percentage of total U.S. consumption from ~2.5% today to between 6.5% and7.5% of total demand by 2030. This nearly threefold increase will reaccelerate the path of electricity demand in the future.

Exhibits 3 and 4

Note: 2030 estimate represents a range, depending on future usage of generative AI.Source: Boston Consulting Group

Morgan Stanley Research estimates that close to 24 gigawatts (GW) of U.S. nuclear capacity today is well suited for datacenters. Assuming half of this power could be used by datacenters, our researchers project 12 GW of available data center capacity. Theoretically, this volume of available U.S. nuclear capacity could provide the needed power for only slightly more than two years of U.S. data center growth. We thus anticipate seeing more similar transactions. With limited nuclear capacity and resounding carbon neutral goals for mega-cap hyperscalers, we believe renewables, such as solar and wind, combined with battery storage, will play an increasing role in behind-the-meter power solutions. This is driving our positioning through the sectors.

Bottom Line: Utilities experienced the largest historical relative underperformance to the broader market in 2023, owing mostly to the sharp move higher in interest rates and declining demand for renewable energy. In our view, this makes the reward relative to risk quite compelling for a sector that is experiencing an inflection in fundamentals. We also believe renewable energy trends will remain intact, but investors need to be focused on those companies that can do it at scale and with a balance sheet able to handle additional capital expenditure (capex). Active management and positioning remain very important in developing the appropriate portfolio through this dynamic.

1Hyperscalers are large cloud service providers of computing and storage at enterprise scale.

2The first pillar shows the current trajectory for utility/power growth in the US, based on available data as of April 24, 2024. The following three bars show the increased need for power due to more intelligent computing with AI - H100 and A100 are different NVIDIA chips. The second bar shows with just the shift in chips, as companies start using the new chips, the increased need for power. The third bar shows the demand additional Gen AI use cases will put on power (these are estimated cases based on proprietary MS research data), and the last bar again shows the additional power needed. All three bars on the right show the increased demands with more AI usage that it will put on utilities/power.