Insights

Will Rolling T-Bills Be an Uphill Battle in 2023's Second Half?

Featured

Will Rolling T-Bills Be an Uphill Battle in 2023's Second Half?

Latest

All Articles ()

There are currently no articles for this filter

Boston - Bond investors principally focus on two main risks: credit risk and interest rate risk. However, reinvestment risk, which is rarely top of mind for investors, deserves closer attention. Reinvestment risk is simply the risk that a bond investor will have to reinvest proceeds from maturing bond at a lower rate than they earned previously.

Investors certainly learned about interest rate risk over the past year, as the Fed hiked rates 500 basis points, precipitating the worst year for bond markets most investors had ever witnessed. As painful as those losses were, the market shift ushered in yield levels not seen since before the Global Financial Crisis (GFC) and today a plethora of high yielding bond options are available to investors.

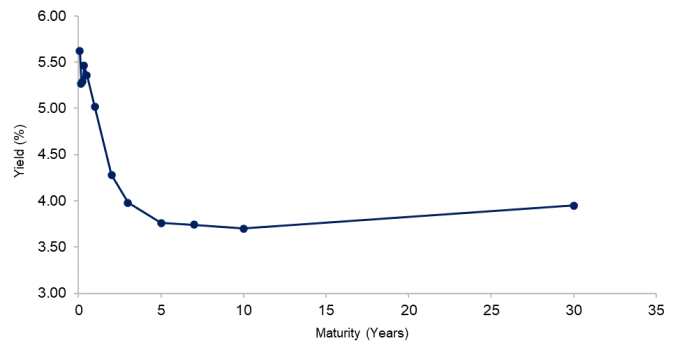

Two years ago, for example, a BB-rated high yield bond yielded just 3.00%, whereas today a 1-month T-Bill yields 5.46%. The issue with the T-Bill is that you can only collect that near 5.50% yield (annualized) for just one month, and after that, the curve begins to massively invert, which means you will eventually be rolling into lower yielding bonds. The situation raises an important question on future rates: Will today's T-Bill yields remain attractive in a month from now? How about in six months?

U.S. Treasurys: Inverted yield curve may raise reinvestment risks

Source: Bloomberg. As of May 19, 2023.

Bond investing today

Since 1985, the federal funds rate has risen above the 30-year Treasury yield just 11% of the time, whereas the other 89% of the time, the yield curve was upward sloping.1 Intuitively, this makes sense as, more often than not, investors aren't bracing for recession and can take interest rate risk with adequate compensation further out on the yield curve. Upward sloping yield curves also provide the added benefit of roll down, which sees bond prices rise as they mature and roll down the steep yield curve toward lower yielding/shorter tenor segments.

Obviously, we are not in a steep yield curve environment today. In fact, the U.S. has the most massively inverted yield curve since the early 1980s. What does this mean for investors? First and foremost, a key engine of bond performance has blown out, as rolling down the yield curve could imply a loss depending on the curve's inversion (for example, moving from a lower-yielding 5-year point to a higher-yielding 4-year point would see a bond's price decline).

Generally, bond investing is much easier in a flat or upward sloping yield curve environment. If the curve is flat and the Fed is at 5.25%, for example, you may find 5.25% attractive and want to lock in that rate for 10 or more years. As mentioned above, T-Bill yields are now well above 5.00%, which is extremely compelling compared to their 0.37% median for the last decade. While you might want to lock in that 5.00%-plus yield for, say, 10 years, you cannot. Currently, the U.S. government only pays 3.80% and 3.70% for 5-year and 10-year issues, respectively.

Allure in the agency MBS market

Should an investor take a position in the 5.46% T-Bill, which only pays you that for one month? Remember that if the forward Treasury curve is correct, an investor would reinvest proceeds at lower yields as each bond matures. Is adding credit risk the answer? Probably not for this portion of the portfolio, as an investor would likely be going into U.S. Treasurys to begin with, specifically to avoid credit risk, perhaps in fear of a recession.

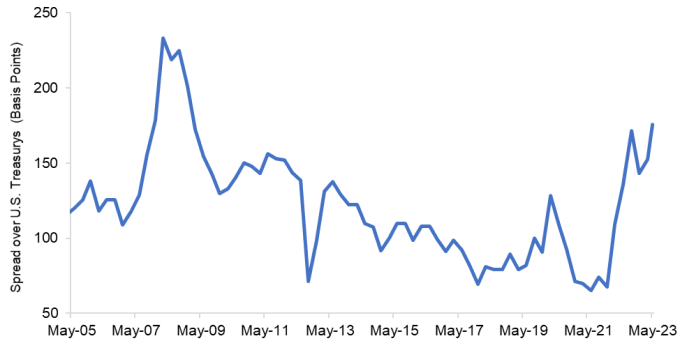

In our view, an investor trying to navigate the curve and avoid that credit risk should consider the U.S. government agency MBS market. At present, the market is trading at what we believe are extremely attractive levels. Spreads today are 179 basis points (bps) over U.S. Treasurys in the par coupon bond and close to 200 bps over for higher coupon bonds. By comparison, spreads were only 60 bps over Treasurys two years ago.

Attractive pricing in agency MBS

Source: Bloomberg. As of May 19, 2023.

The agency MBS market, like most other bond markets, experienced weakness on rising interest rates last year. But unlike other high quality bond markets (for example, investment grade corporates, which barely have widened in the past year), agency MBS spreads are now three times wider than they were two years ago and sit at levels not seen since the GFC. While high mortgage rates may dampen demand in the housing market, they benefit agency MBS investors, who can now buy 5.5% coupon bonds below par or 6.0% coupon bonds below $101 for explicitly backed U.S. Government National Mortgage Association (Ginnie Mae) bonds.

What's the catch?

It is reasonable to wonder why spreads are so wide without the credit risk. Is it because of the interest rate risk? Yes, but for investors already considering moving out on the curve in hopes of earning higher yields, that's a risk they were already willing to take.

There is also prepayment risk, but with a 6.0% coupon bond trading just above par, or a 5.5% bond trading below par, when you receive a prepayment, the risk is minimal as you are essentially getting that same 100 cents on the dollar back. Experienced MBS managers can further protect from prepayment risk through an active and discerning approach to selection. In turn, this should allow investors in agency MBS to earn yields in excess of comparable U.S. Treasurys and to lock these in for longer.

Today, explicitly backed, U.S. government-guaranteed Ginnie Mae bonds offer yields close to 6%, whereas a 1-month T-Bill offers 50 bps less. In our view, this level of yield pickup is very compelling.

We believe agency MBS offer a potential spread advantage too. They are meaningfully wider than long-term averages, which could arguably reflect uncertainty around the Fed's balance sheet runoff and recent challenges in the regional banking sector. However, spreads are three standard deviations wider than average levels, which we believe presents a highly attractive entry point. Potential tailwinds for the sector are on the horizon as well, with core bond fund managers starting to rotate out of corporates and into agency MBS. We expect this would continue if the U.S. economy decelerates further and prompts a flight to higher quality assets. And if the economy ultimately heads into a recession, the Fed could opt to pause quantitative tightening, dramatically reducing supply in the MBS market.

Bottom line: Today's high front-end Treasury yields may entice investors to just roll T-Bills, but for investors seeking to avoid the reinvestment risk associated with such a strategy and to lock in today's high yields for more than just one month, we think the agency MBS sector merits consideration. The agency MBS sector not only offers a yield advantage over comparable U.S. T-Bills, but investors can also access this U.S. government-backed sector at historically attractive valuation levels.

1 Bloomberg. As of April 30, 2023.